Sharing documents with your tenants

Coming in April

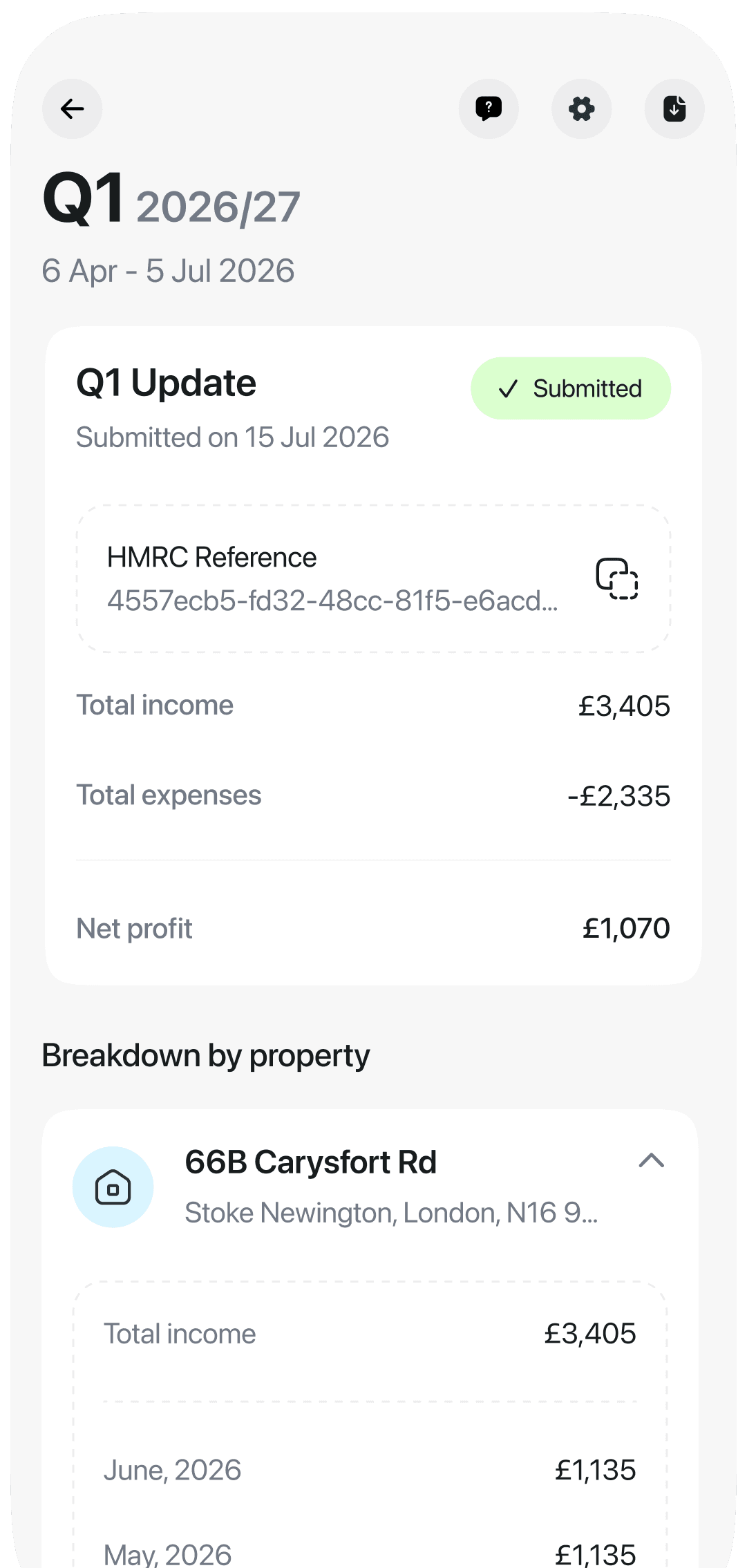

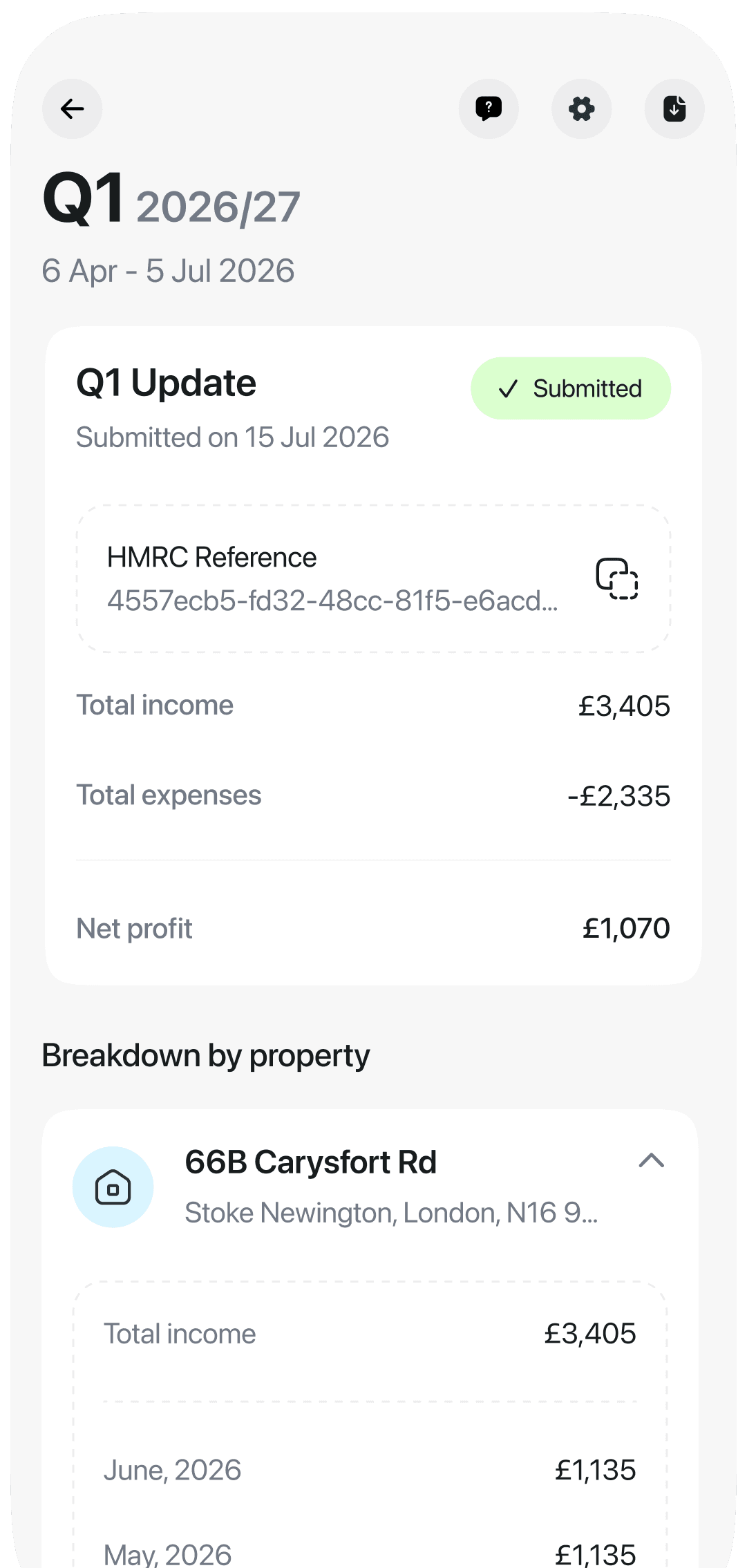

Making Tax Digital

Making Tax Digital

Making Tax Digital

Software for Landlords

Software for Landlords

Software for Landlords

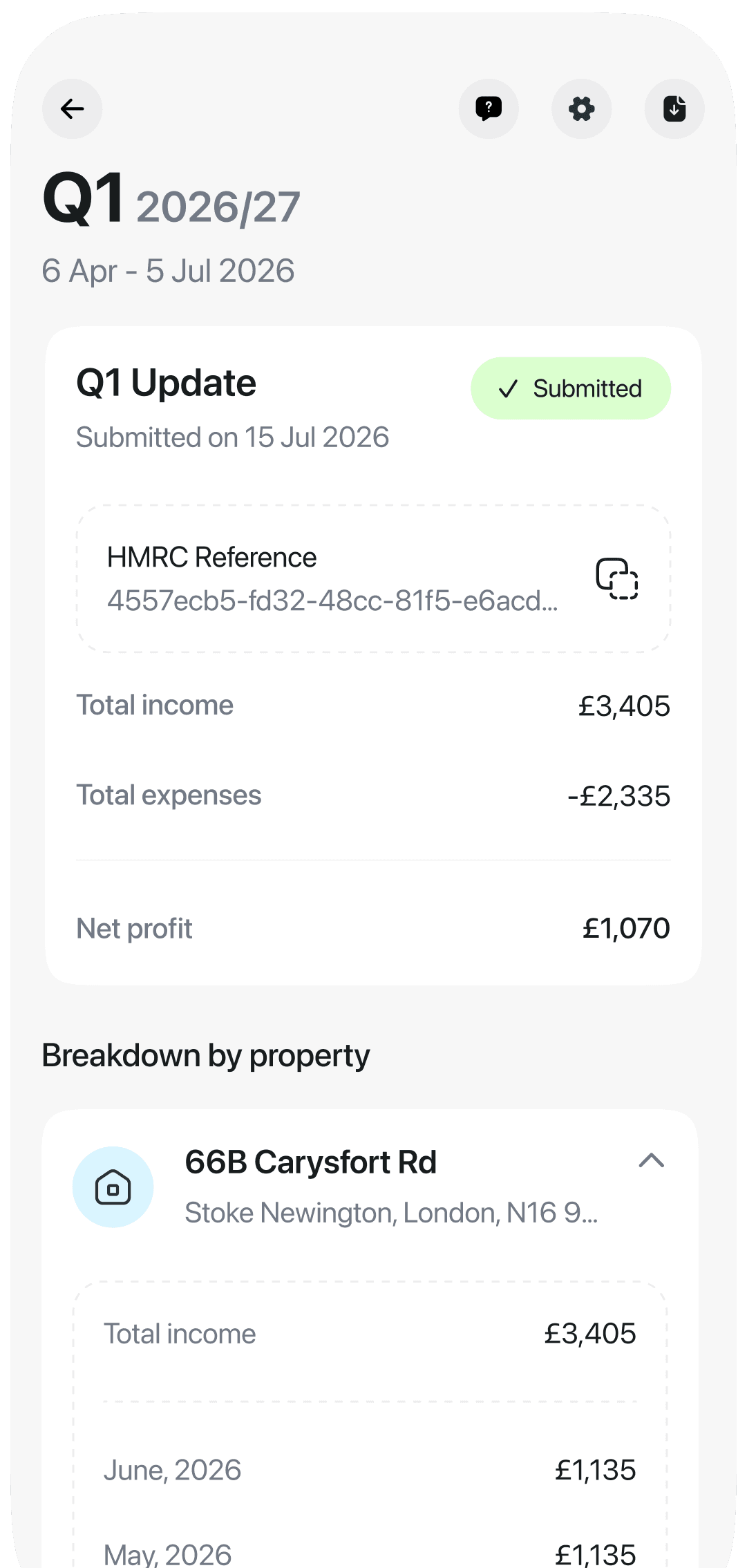

Digitise your receipts, track your rental income, and make your MTD submissions all in one place.

Digitise your receipts, track your rental income, and make your MTD submissions all in one place.

Digitise your receipts, track your rental income, and make your MTD submissions all in one place.

Maintain digital records

Direct HMRC integration

Simple to submit

Estimate your MTD start date

Enter your rental income and expenses to see your estimated tax bill, and when MTD will apply to you.

Estimate your MTD start date

Enter your rental income and expenses to see your estimated tax bill, and when MTD will apply to you.

Estimate your MTD start date

Enter your rental income and expenses to see your estimated tax bill, and when MTD will apply to you.

New to Self Assessment?

Step-by-step guide to registering with HMRC as a landlord. UTR numbers, deadlines, and what happens if you're late.

New to Self Assessment?

Step-by-step guide to registering with HMRC as a landlord. UTR numbers, deadlines, and what happens if you're late.

MTD Complete Guide

Quarterly updates, digital records, deadlines, exemptions, and how to prepare before April 2026.

MTD Complete Guide

Quarterly updates, digital records, deadlines, exemptions, and how to prepare before April 2026.

What is

What is

What is

MTD?

MTD?

MTD?

Making Tax Digital for Income Tax (MTD for IT) is a fundamental change to the UK tax system that transforms how landlords report their income to HMRC.

Making Tax Digital for Income Tax (MTD for IT) is a fundamental change to the UK tax system that transforms how landlords report their income to HMRC.

Making Tax Digital for Income Tax (MTD for IT) is a fundamental change to the UK tax system that transforms how landlords report their income to HMRC.

Starts April 2026 for landlords earning £50k+

You'll need to keep digital records

Replaces annual returns with quarterly updates

Requires approved software (that's where we come in)

When

When

When

do the

do the

do the

new

new

new

MTD

MTD

MTD

rules

rules

rules

apply?

apply?

apply?

The Making Tax Digital rules are being phased in based on your qualifying income from rental properties and self-employment.

April 2026

April 2026

Phase 1:

Landlords earning £50,000+

The first wave. If your combined rental and self-employment income tops £50k, you'll need to go digital and file quarterly.

April 2026

Phase 1:

Landlords earning £50,000+

The first wave. If your combined rental and self-employment income tops £50k, you'll need to go digital and file quarterly.

April 2026

Phase 1:

Landlords earning £50,000+

The first wave. If your combined rental and self-employment income tops £50k, you'll need to go digital and file quarterly.

April 2027

April 2027

Phase 2:

Landlords earning £30,000+

The threshold drops. Landlords with qualifying income over £30,000 must now comply with MTD requirements.

April 2027

Phase 2:

Landlords earning £30,000+

The threshold drops. Landlords with qualifying income over £30,000 must now comply with MTD requirements.

April 2027

Phase 2:

Landlords earning £30,000+

The threshold drops. Landlords with qualifying income over £30,000 must now comply with MTD requirements.

April 2028

April 2028

Phase 3:

Landlords earning £20,000+

Most landlords are now in scope. If that's you, you'll want to be ready well before this date.

April 2028

Phase 3:

Landlords earning £20,000+

Most landlords are now in scope. If that's you, you'll want to be ready well before this date.

April 2028

Phase 3:

Landlords earning £20,000+

Most landlords are now in scope. If that's you, you'll want to be ready well before this date.

How to calculate your qualifying income

Add up your total rental income for the tax year before expenses. HMRC will use your 2024-25 tax year income to determine if you need to comply by April 2026. If you're close to a threshold, it's worth preparing early.

How to calculate your qualifying income

Add up your total rental income for the tax year before expenses. HMRC will use your 2024-25 tax year income to determine if you need to comply by April 2026. If you're close to a threshold, it's worth preparing early.

How to calculate your qualifying income

Add up your total rental income for the tax year before expenses. HMRC will use your 2024-25 tax year income to determine if you need to comply by April 2026. If you're close to a threshold, it's worth preparing early.

Meet

Meet

Meet

MTD

MTD

MTD

requirements

requirements

requirements

with

with

with

August

August

August

Everything you need to go digital and stay on top of your taxes.

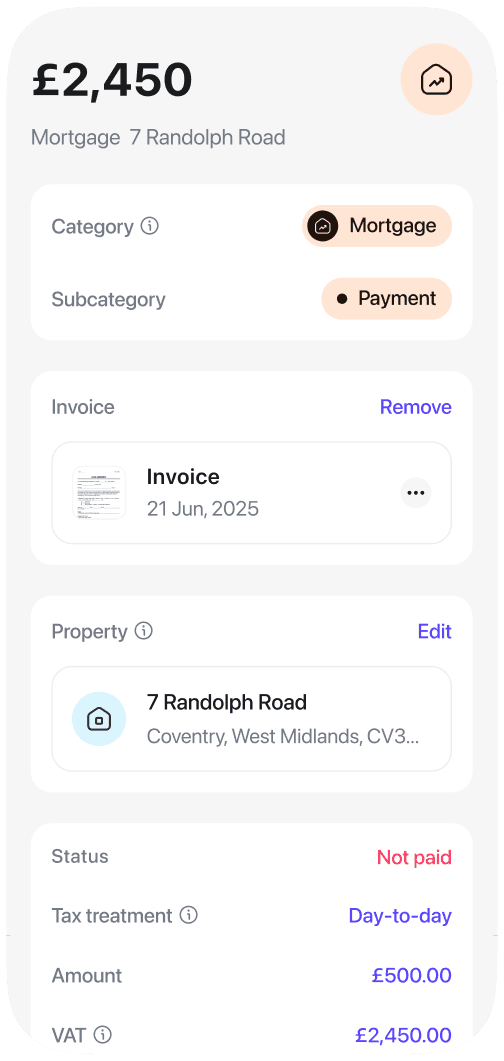

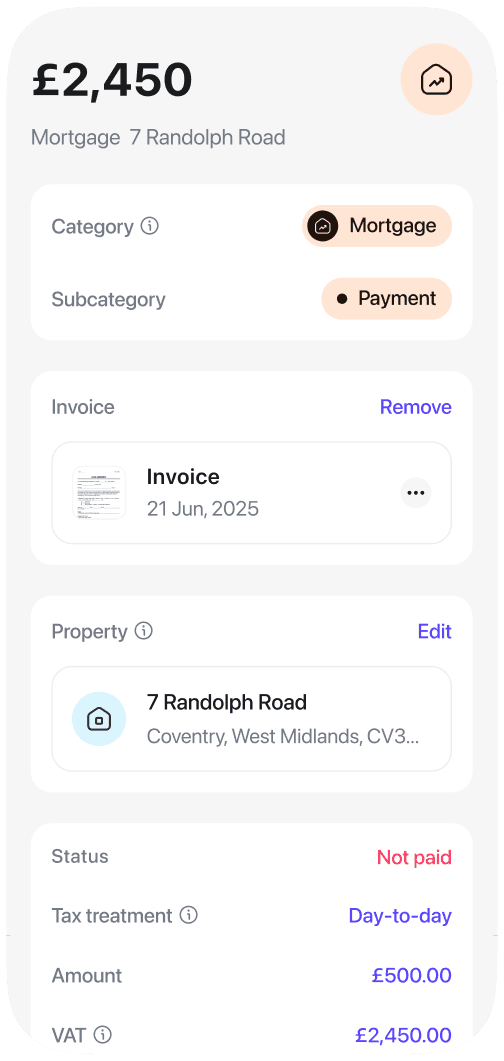

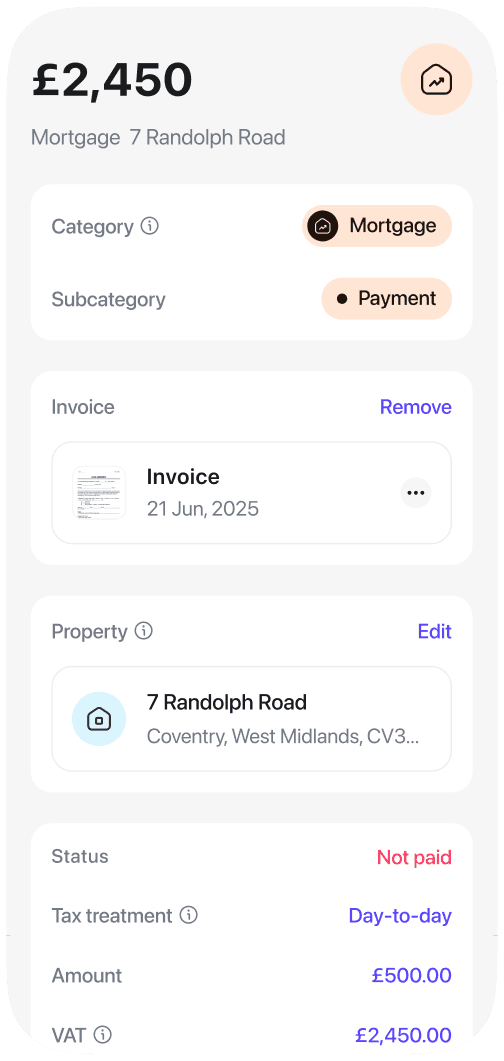

Expense Tracking

Keep

your receipts in

one

place

Snap a photo, link it to an expense, tag the property. When tax time comes, it's all there. Organised and MTD-ready.

"I used to dump everything in a spreadsheet and panic at tax time. Now it's all organised as I go."

“Thought I was all set until August told me I hadn’t shared the ‘How to Rent’ guide. Turns out that alone could’ve voided my ability to evict.”

James T.

Landlord from Manchester, 3 properties

Expense Tracking

Keep

your receipts in

one

place

Snap a photo, link it to an expense, tag the property. When tax time comes, it's all there. Organised and MTD-ready.

"I used to dump everything in a spreadsheet and panic at tax time. Now it's all organised as I go."

James T.

Landlord from Manchester, 3 properties

Rent Tracking

Real-time

bank feeds

Connect your bank account to view and reconcile transactions in real time. Increase your accounting accuracy and speed.

Rent Tracking

Real-time

bank feeds

Connect your bank account to view and reconcile transactions in real time. Increase your accounting accuracy and speed.

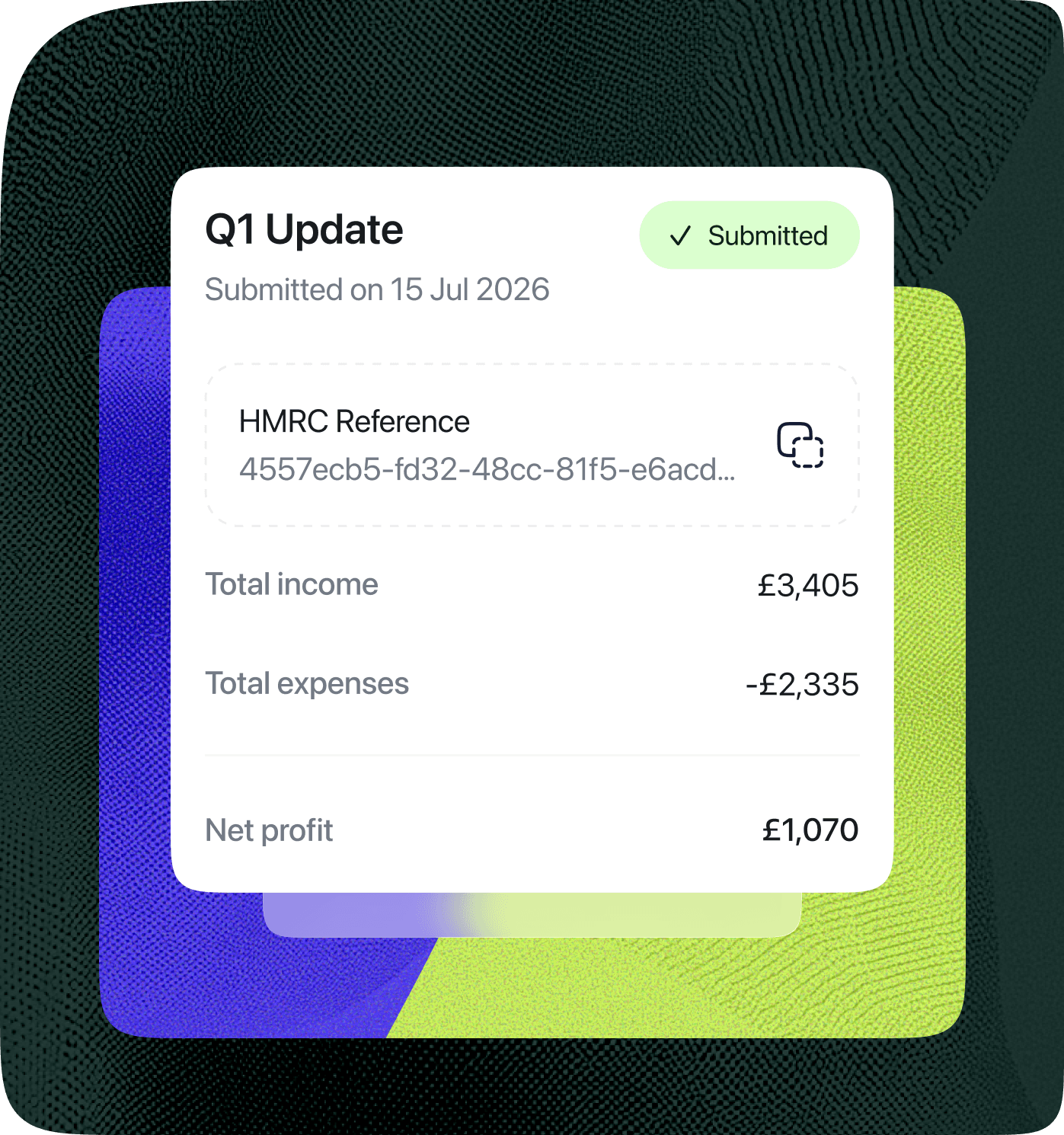

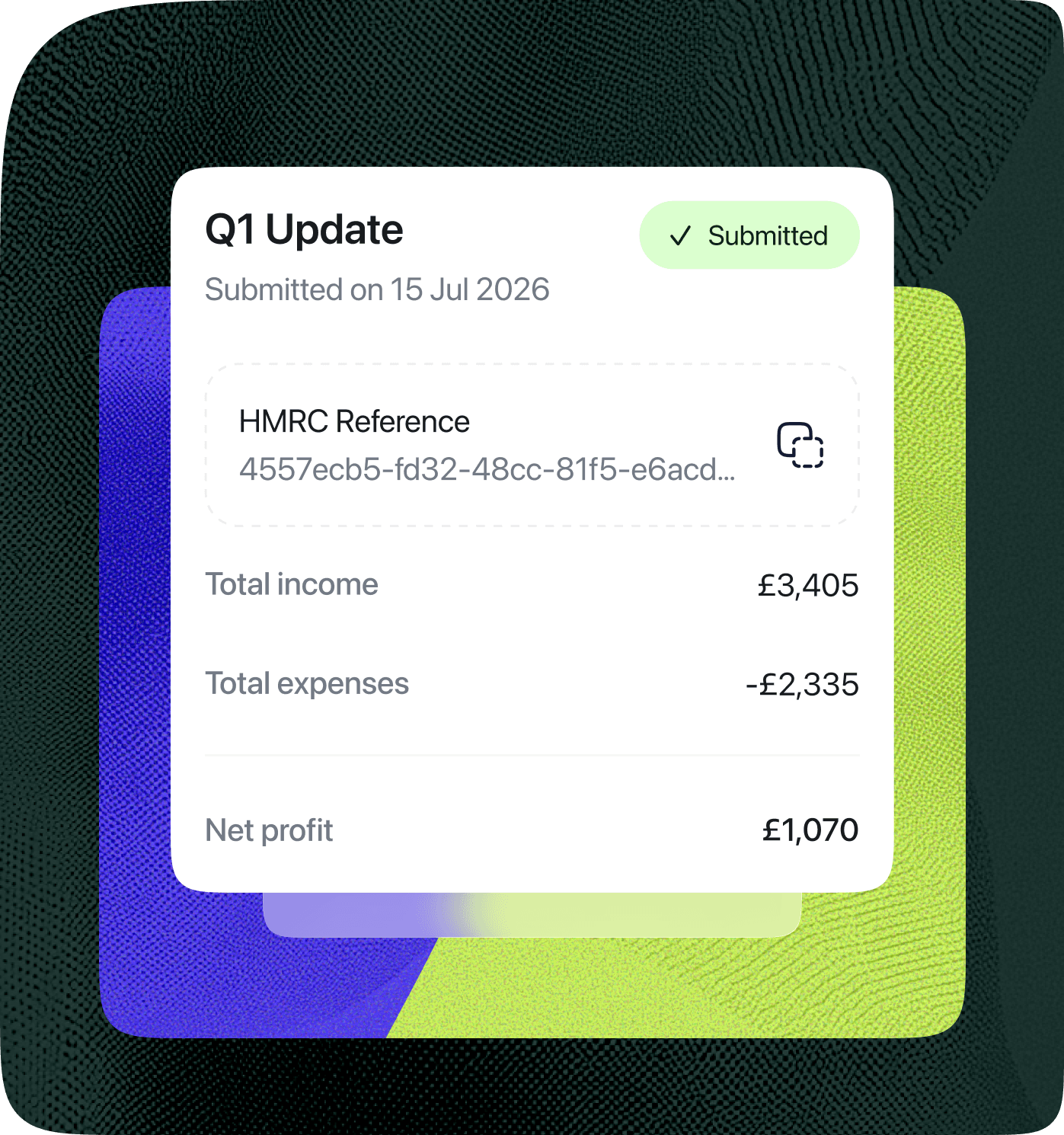

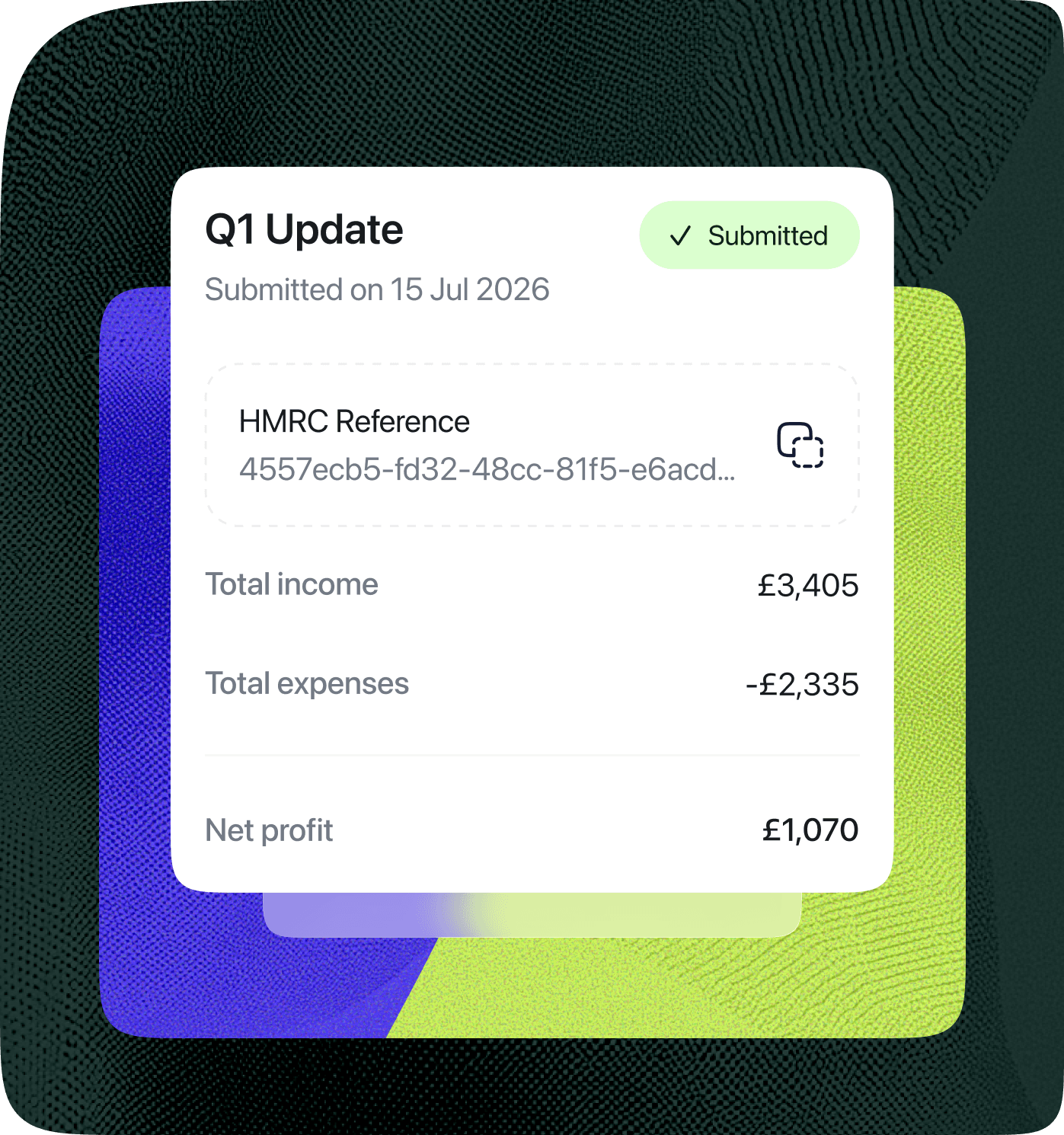

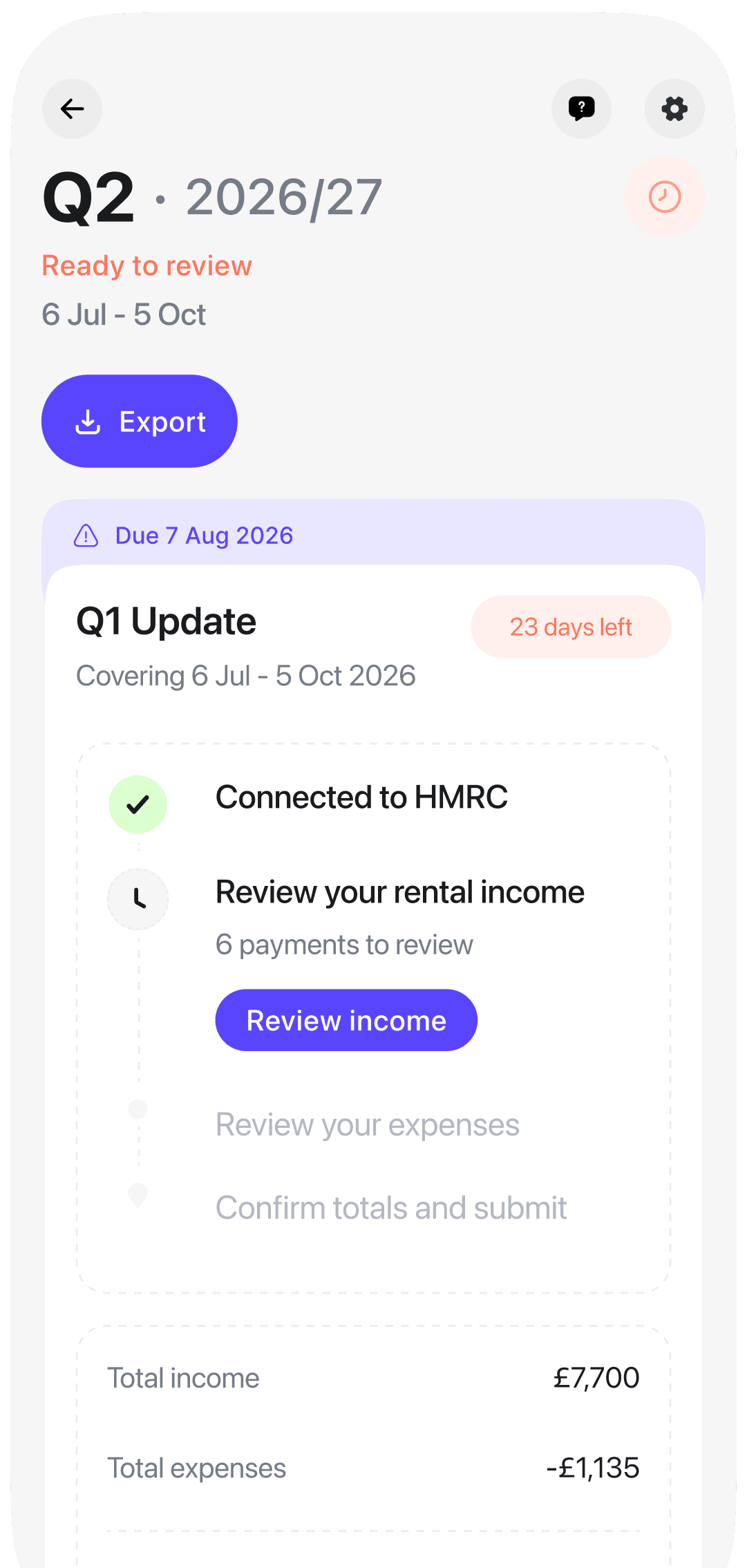

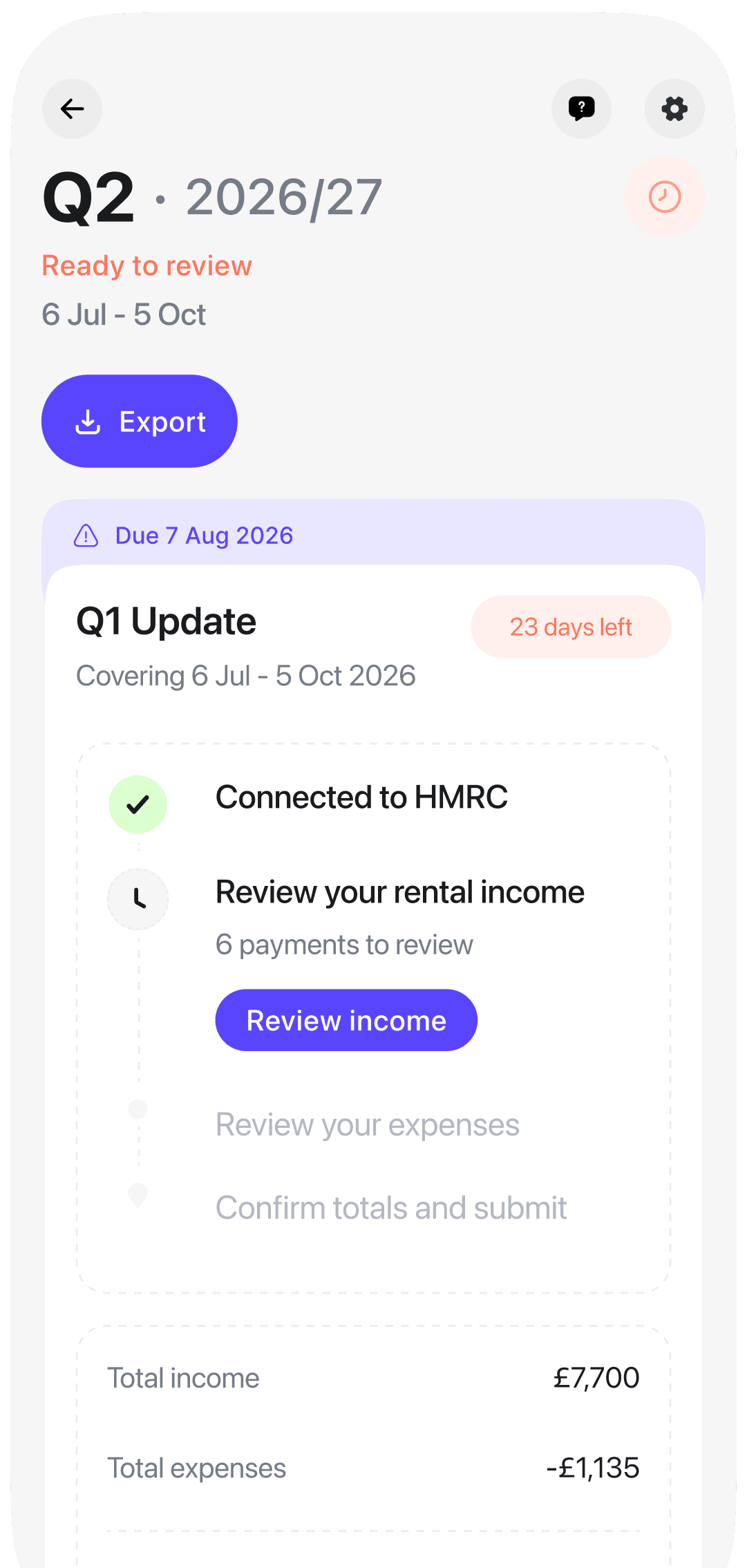

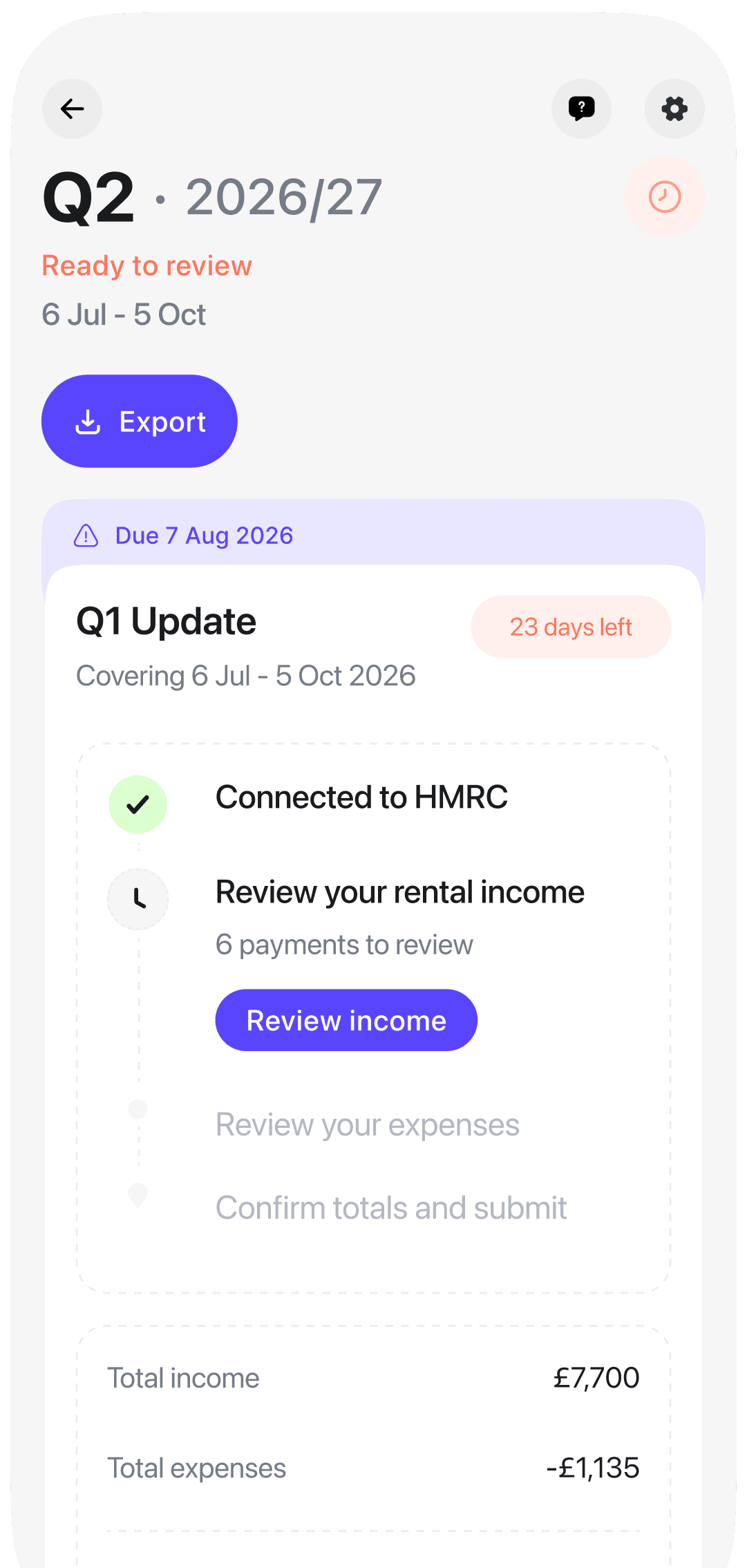

Coming soon

Direct

HMRC integration

Submit accurate quarterly MTD updates and your end-of-year statement directly to HMRC without leaving the app.

Coming soon

Direct

HMRC integration

Submit accurate quarterly MTD updates and your end-of-year statement directly to HMRC without leaving the app.

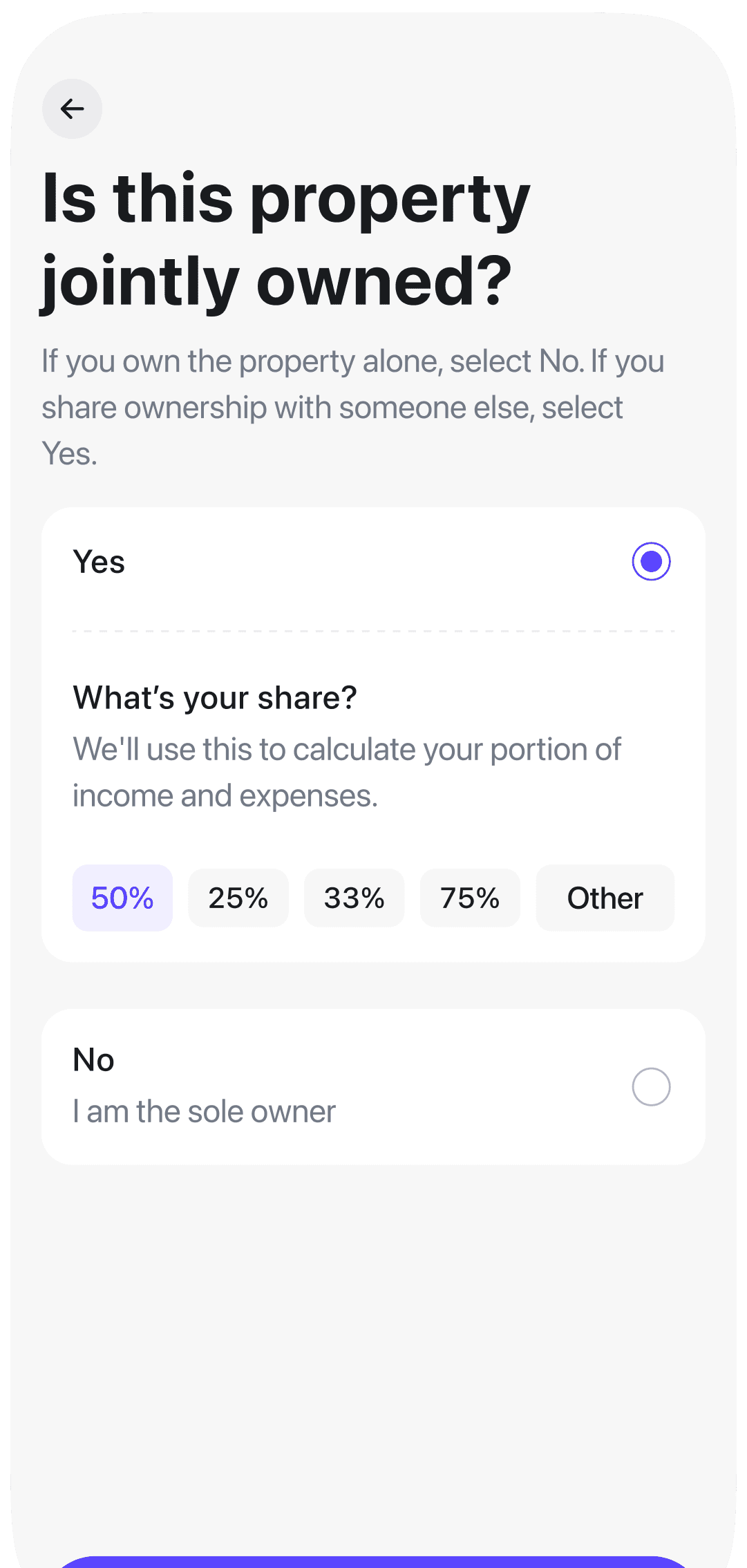

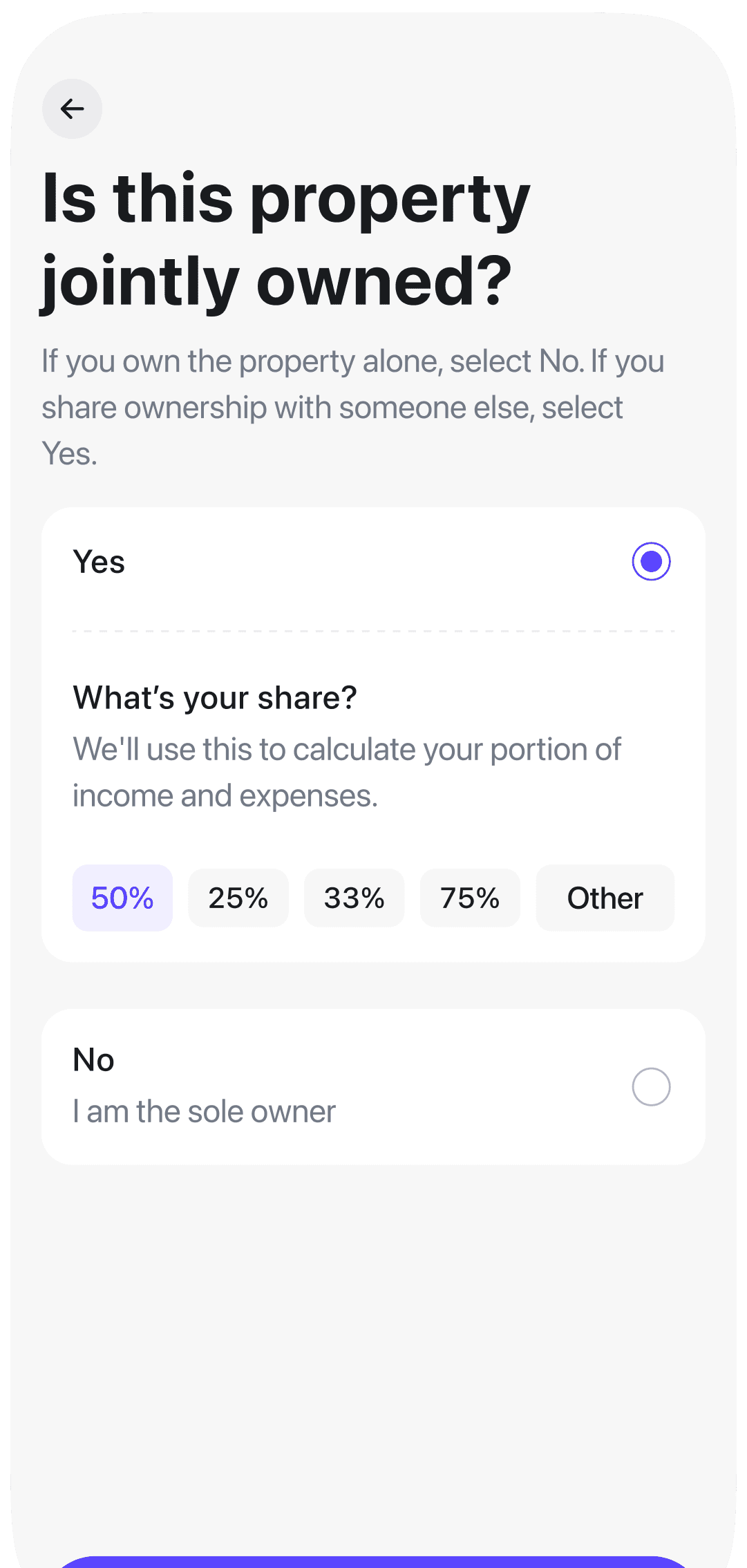

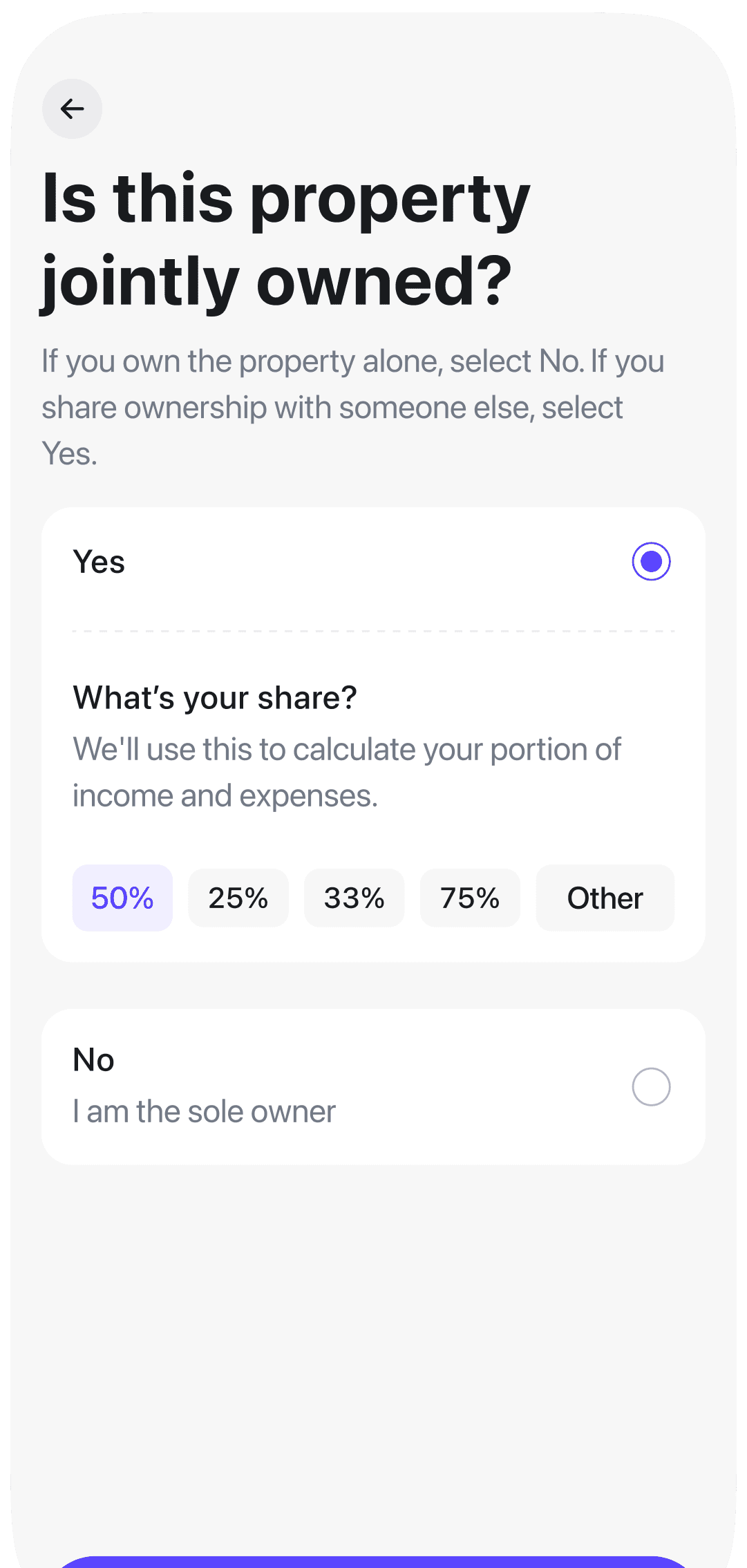

Joint ownership?

No problem

Sole owner, joint owner, partnership. August handles different ownership models, giving you the flexibility you need.

Get ahead of

MTD

MTD isn't here yet, but starting now means you'll be ready when it is.

Why landlords choose August

Built for real landlords,

who do it all themselves

With August

Built for you

Designed specifically for small landlords. Simple, helpful, and clear.

Built for you

Designed specifically for small landlords. Simple, helpful, and clear.

Built for you

Designed specifically for small landlords. Simple, helpful, and clear.

All-in-one app

Everything in one place, rent, expenses (MTD), compliance, documents, reminders, AI property assistant, insights, maintenance and tenants. No more juggling tools.

All-in-one app

Everything in one place, rent, expenses (MTD), compliance, documents, reminders, AI property assistant, insights, maintenance and tenants. No more juggling tools.

All-in-one app

Everything in one place, rent, expenses (MTD), compliance, documents, reminders, AI property assistant, insights, maintenance and tenants. No more juggling tools.

Step-by-step support

Smart checklists and prompts guide you through each stage of the tenancy.

Step-by-step support

Smart checklists and prompts guide you through each stage of the tenancy.

Step-by-step support

Smart checklists and prompts guide you through each stage of the tenancy.

Straightforward pricing

No surprises. No extras. Just one fair price for everything you need.

Straightforward pricing

No surprises. No extras. Just one fair price for everything you need.

Straightforward pricing

No surprises. No extras. Just one fair price for everything you need.

Other tools

Built for Agents

Made for large portfolios, with unnecessary complexity small landlords don’t need.

Built for Agents

Made for large portfolios, with unnecessary complexity small landlords don’t need.

Built for Agents

Made for large portfolios, with unnecessary complexity small landlords don’t need.

Scattered workflows

Docs in folders, rent in spreadsheets, tasks in your head. It’s all disconnected.

Scattered workflows

Docs in folders, rent in spreadsheets, tasks in your head. It’s all disconnected.

Scattered workflows

Docs in folders, rent in spreadsheets, tasks in your head. It’s all disconnected.

No real guidance

You're left guessing what's next and expected to remember everything.

No real guidance

You're left guessing what's next and expected to remember everything.

No real guidance

You're left guessing what's next and expected to remember everything.

Hidden costs

Unclear pricing with surprise fees. It's hard to know what you're really paying for.

Hidden costs

Unclear pricing with surprise fees. It's hard to know what you're really paying for.

Hidden costs

Unclear pricing with surprise fees. It's hard to know what you're really paying for.

Privacy at heart

Made in the UK.

Made in the UK.

Built for trust.

Built for trust.

Strong encryption

We work directly with banks maintaining the highest security. August is regulated by the FCA as an agent of Plaid financial LTD.

Strong encryption

We work directly with banks maintaining the highest security. August is regulated by the FCA as an agent of Plaid financial LTD.

Strong encryption

We work directly with banks maintaining the highest security. August is regulated by the FCA as an agent of Plaid financial LTD.

Straightforward privacy

We keep things simple, we’re GDPR compliant meaning your data stays with you and we never share anything without your permission.

Straightforward privacy

We keep things simple, we’re GDPR compliant meaning your data stays with you and we never share anything without your permission.

Straightforward privacy

We keep things simple, we’re GDPR compliant meaning your data stays with you and we never share anything without your permission.

It's your data

Your data is kept secure like your front door. Locked, and only you hold the key.

It's your data

Your data is kept secure like your front door. Locked, and only you hold the key.

It's your data

Your data is kept secure like your front door. Locked, and only you hold the key.

All for one low monthly

All for one low monthly

All for one low monthly

fee

fee

fee

August is free for tenants. Landlords pay a simple flat fee.

Unlimited properties with up to 6 tenancies

40 documents storage with easy sharing

Unlimited compliance tasks with step-by-step guidance

SMS reminders for what matters most

Everything in "Growth"

Unlimited tenancies no caps

Unlimited document storage & sharing

HMO support with room-level management

Smart tenancy setup with automatic document scanning

Everything in "Portfolio"

Dedicated account manager

Custom integrations capability with your existing systems

Onboarding support & set-up

Audit-ready document logs

Growth

30-day free trial

Unlimited properties with up to 6 tenancies

40 documents storage with easy sharing

Unlimited compliance tasks with step-by-step guidance

SMS reminders for what matters most

£

8.99

Billed monthly • Cancel anytime

Portfolio

30-day free trial

Everything in "Growth"

Unlimited tenancies no caps

Unlimited document storage & sharing

HMO support with room-level management

Smart tenancy setup with automatic document scanning

£

14.99

Billed monthly • Cancel anytime

Portfolio Plus

30-day free trial

Everything in "Portfolio"

Dedicated account manager

Custom integrations capability with your existing systems

Onboarding support & set-up

Audit-ready document logs

£

29.99

Billed monthly • Cancel anytime

Unlimited properties with up to 6 tenancies

40 documents storage with easy sharing

Unlimited compliance tasks with step-by-step guidance

SMS reminders for what matters most

Everything in "Growth"

Unlimited tenancies no caps

Unlimited document storage & sharing

HMO support with room-level management

Smart tenancy setup with automatic document scanning

Everything in "Portfolio"

Dedicated account manager

Custom integrations capability with your existing systems

Onboarding support & set-up

Audit-ready document logs

Automate

Automate

your rentals today

your rentals today

30-day free trial

Cancel anytime

Setup in under 5 minutes

FAQ

Got questions?

We've got answers

Answers to the most common questions about documents, including document product updates.

Answers to the most common questions about documents, including document product updates.

Sharing documents with your tenants

Sharing documents with your tenants

Where can I find my tenancy documents?

Where can I find my tenancy documents?

Where can I find my tenancy documents?

What is the Documents feature for?

What is the Documents feature for?

What is the Documents feature for?

What files and formats can I upload to Documents?

What files and formats can I upload to Documents?

What files and formats can I upload to Documents?

How do I assign a document to multiple tenants or properties?

How do I assign a document to multiple tenants or properties?

How do I assign a document to multiple tenants or properties?

How do I edit or add information to a document?

How do I edit or add information to a document?

How do I edit or add information to a document?

Can I share documents with my tenants?

Can I share documents with my tenants?

Can I share documents with my tenants?

Where can I find my recently uploaded documents?

Where can I find my recently uploaded documents?

Where can I find my recently uploaded documents?

Can I categorise documents?

Can I categorise documents?

Can I categorise documents?

How do landlords upload a document to August?

How do landlords upload a document to August?

How do landlords upload a document to August?

Join our email list

Get exclusive insights, actionable advice, and the latest updates delivered straight to your inbox.

By continuing you agree with our Privacy Policy

Join our email list

Get exclusive insights, actionable advice, and the latest updates delivered straight to your inbox.

By continuing you agree with our Privacy Policy

Join our email list

Get exclusive insights, actionable advice, and the latest updates delivered straight to your inbox.

By continuing you agree with our Privacy Policy